This is the 3rd article in a series in which I explore my core values and how they relate to the core values of the college I founded. If you have any questions, comments, suggestions, or would like to share your own stories, I’d love to hear them! Please share below.

For the first two years of starting a college from scratch - Wayfinding Academy - I chose to not accept a salary. I was in my late 30’s. I didn’t have any children or a spouse to support. I lived in my tiny house with few expenses and I was more than comfortable not living beyond my means. When I made the choice to live without an income I was confident I would survive, but I wasn’t sure what my life would be like on the other side.

I think I might be stubborn or maybe I’m overconfident or willfully determined. I’m not sure they are not all that different. I’ve spent most of my life being outright bullheaded about not letting finances be a barrier for my goals, possibly to a fault. I try not to say I hate things, but I can confidently say I hate money. I would scream it from my rooftop, if my roof wasn’t only 15 feet from the ground and in someone else’s backyard. I hate how money has become a symbol of success, I hate how money affects relationships, and I hate how money halts people from doing work they care about. I think not letting money be a deciding factor in starting Wayfinding and achieving my goals has been my way of thumbing my nose at the whole thing.

My decision to not take a salary happened around the time the founding team and I were creating the financial model for the college. We were all too aware of the pay inequities on traditional college campuses and we were looking to create a system where everyone, regardless of position, makes the same salary prorated based on the number of hours they work (i.e, ½ time or full-time). And we wanted to do this all with full transparency.

At the time, we calculated that based on the average cost of living in Portland, the Wayfinding salary would be $40,000 per year for everyone on the team. Although this was Portland six years ago and things were remarkably less expensive, I was still aware this was not the greatest living wage. I also knew by nature of being a start-up I was going to ask people to do a lot more work than I could compensate them for, and I wasn’t completely comfortable with this. In the interest of equity, security, and integrity, I decided my best course of action would be to forego my own salary from Wayfinding for one year, possibly two.

At Wayfinding we teach the importance of making informed and intentional decisions. At this point my decision was intentional, but not fully informed. I was a full-time Associate Professor at Concordia University with the goal of leaving ASAP to focus my attention fully on Wayfinding. If I was to survive two years without an income I needed to calculate how much money I would need to save and how long it would take me to do so before I could resign from my current job.

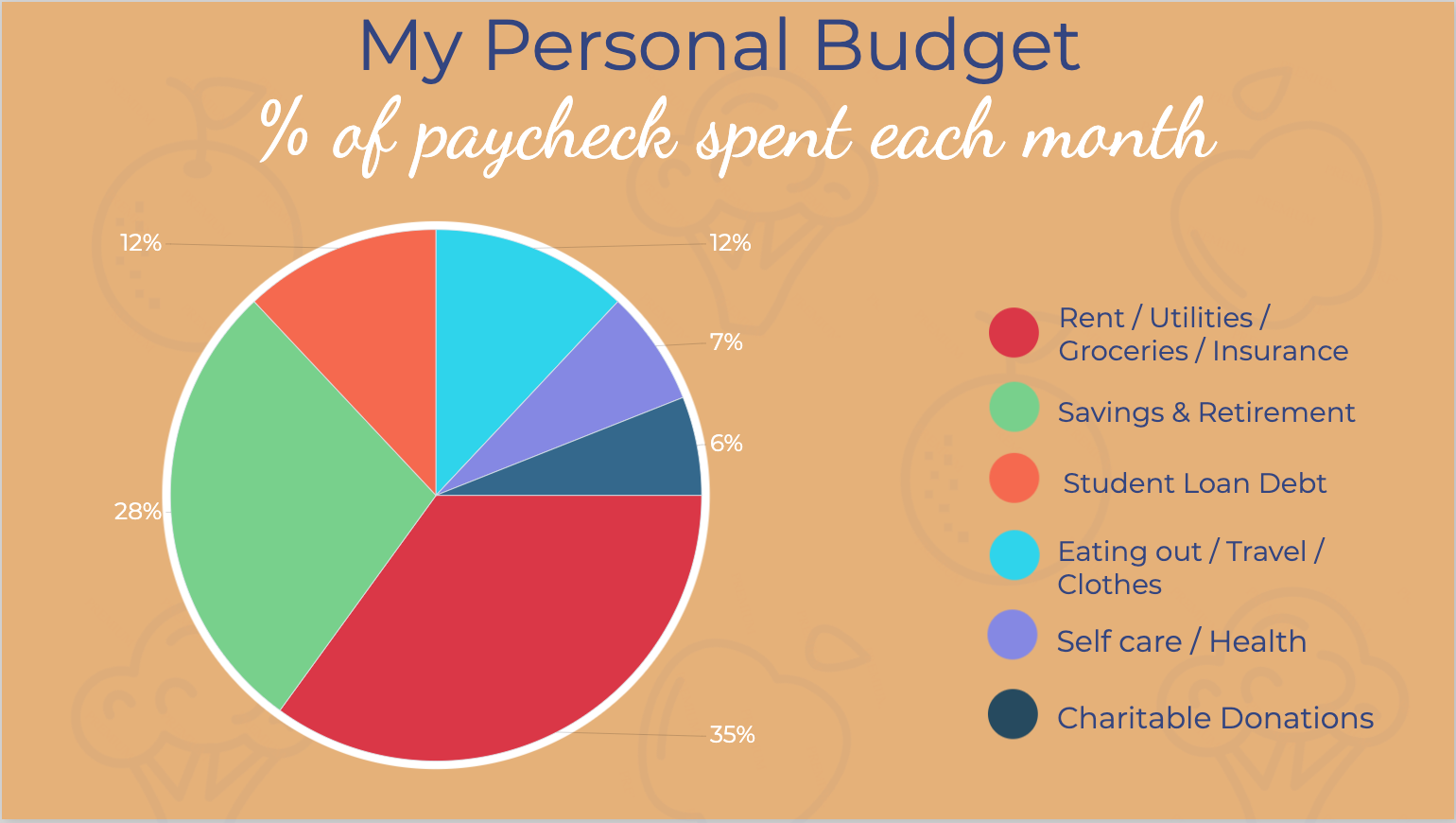

I started with the goal of saving 50% of my income every month. Then I made painstakingly detailed charts of my monthly expenses and tried to see where I could cut corners to make up my 50%. Living in my tiny house is relatively inexpensive, so not much needed to be cut from there. The first thing to be cut significantly from my budget was travel.

Travel has always been an important part of my life. It’s through travel that I’ve gained a better appreciation for other cultures and ways of life. Travel has been a tool to help me dismember many of my own implicit biases and stagnant world views. My views on the importance of travel to help cultivate open-mindedness were widely shared by the founding team, which is why ”learn and explore trips” are such an integral part of the Wayfinding experience.

I knew travel was going to have to vanish from my expenses, but that didn’t necessarily mean it needed to vanish from my life. In an effort to sustain my love of adventure, I began learning “travel hacking.” This is essentially finding creative ways to get airline miles and hotel points for free that can be used for travel. I typically acquire points through credit card bonuses, shopping portals, dining programs, and online surveys. It’s through travel hacking that I was able to lead Wayfinding's first learn and explore trip to walk the Camino de Santiago pilgrimage in Spain for 3 weeks for only $250! Travel hacking has become such an integral part of my life that I now teach a workshop on it for the Wayfinding community.

Once I removed travel expenses and a few other non-essentials from my budget, I estimated I would need to save $30,000 to sustain myself for two years without an income. With my Concordia salary being what it was, I figured that with a combo of self-discipline and a lot of instant ramen meals I could achieve my goal within one year. In the meantime, I would continue teaching and working on Wayfinding in my free time.

One fall morning I went in to tell my boss, the Academic Vice President, that I would be leaving the following year to start my own college. I was a little uncertain how he was going to react. After a brief moment of silence he said, “That sounds great! You should definitely do that, but I think you should stay one additional semester. Otherwise you’ll be just a few months shy of qualifying for your retirement plan and it would be a shame if you left without it.”

I was a little taken aback that he would want me to continue my full-time role knowing that my mind would be elsewhere during my final semester and that he was rooting for me to exit with my retirement package. He responded quickly with something like, “You have been giving this college 110% since you started five years ago. You are on all the volunteer teams and committees. If you need to give a little less for your last semester while your mind is on starting a new college, I don’t think anyone would hold it against you.” I was stunned by his generosity and kindness.

The year went by rather quickly and by the time I was ready to leave my position, I found myself at a crossroads. Even with the small boost of my retirement fund from Concordia, I had only saved up $13,000. Not even half of my goal. I could either continue working until I saved enough money or I could go on with my plan, not knowing what those two years might bring. I was determined to follow my own philosophy and not let finances stand in the way, so I resigned from my teaching job. I could always solve the problem of making more money, but I wouldn’t always have the momentum to start my own college.

During my two years without a salary, my privilege as a white woman with a stable family and home was never too far from my mind. I struggled not having any income. I was disciplined with my money every month, rarely eating out, walking everywhere I could, cutting corners in lots of ways, but I was still stressed every day. I laid awake at night imagining the things that would bring it all crashing down - an unexpected hospital bill, car trouble, a tree falling on my house. I could push the thoughts away for a week or two but they always came back. Like clockwork, everytime I renewed my food stamps and had to explain to a new person that I was not looking for a job because I was volunteering full-time at my own non-profit, my head would swarm with the possibility of my food stamps ending and me needing to strategize new ways to get groceries every week. I was constantly doing financial gymnastics in my head making it difficult at times to live in the present. I opened up two new credit cards (with large airline mile bonuses, of course!), in spite of my better judgment, trying to mitigate my financial stress and keep it from overtaking my work. This helped for a bit.

After about a year and a half, though, my $13,000 in savings ran out completely and I had maxed out both my new credit cards. I was in a panic. I had gotten into a car accident two years prior and totaled my car. A good friend lent me the money to get a replacement car (which I'm still paying back) and I foolishly spent all the money he loaned me on a brand new car. Fortunately, this mistake ended up helping me in the end. I took the new car to a dealership, traded it in for a much cheaper used car, and pocketed the $4,000 cash remaining. If it wasn’t for this I surely would not have been able to keep my head above water for the rest of the year.

On August 1st, 2017 I received my first paycheck from Wayfinding Academy. I sat in my office alone just staring at this paycheck. At this moment, despite my resentment toward money, it felt amazing to hold that check in my hands. I had done it! I made it through the two years and had started the college of my dreams. Before I knew it, as a feeling of relief washed over me, I began to cry. After a moment, I collected myself, put the paycheck safely in my drawer, and got back to work. I had a college to run.

My financial situation has changed a bit in the last few years, but many of the habits I created during that time without an income have stuck with me. Since I remain the lowest-paid employee at Wayfinding with an annual salary of $31,000, I still need to keep a strict track of my finances using my budgeting spreadsheet. The consistency of my monthly paychecks helps me to budget in the things I care about, like donating to nonprofits and taking friends out to dinner. I currently contribute monthly to Alder Commons, Carpe Mundi, Kairos PDX, and Abolitionist Teaching Network. I’m even a Wayfinding Luminary (that’s what we call our monthly donor program).

Two years living without an income helped me put into perspective how privileged I have been in my life. How lucky I am to have the choice to quit my job and start my own college. How lucky I am to have such supportive friends and family who could catch me if I fell. I’m aware of the societal barriers such as systemic racism and generational wealth inequity that limit many folks who might dream of quitting their job to follow professional ambitions. These cultural barriers that I, myself, do not face are some of the main reasons I wanted to start Wayfinding.

I believe the world would be a better place if everyone had the opportunity to do the work they dream of doing. I know this is a far cry from present-day reality, but the Wayfinding team works hard every day to get us closer to that new world. I tell this story to demystify the experience of starting a nonprofit, as well as share my experience of the financial hacks, commitments, and sacrifices it might require. I do hope to inspire others to follow their passions, but I also want to emphasize that purpose-driven work should not be this difficult to pursue in our society. Small business owners and nonprofit founders should not have to put their lives on the line to make their passions into reality. The sooner that we, collectively, acknowledge that we have chosen to give power to monetary values and the draining corporate 9-5, the sooner we can unlearn these norms. When enough of us understand this, we might just recognize the endless possibilities that come from work driven from a place of joy, rather than a place of necessity. I never gave up on my dreams because I never doubted that they were possible. Living your dreams is absolutely possible. That being said, the journey is not always going to be an easy process. Solidify your support system, be honest with yourself regarding your needs, stay grateful and humble, and never stop encouraging others to pursue what they love.

If you would like to learn more about Wayfinding Academy and the fight to revolutionize higher education please visit wayfindingacademy.org

If you would like to learn more about me or my thoughts on alternative higher education check me out on my social media pages:

Twitter: https://twitter.com/MichelleDJones8

LinkedIn: https://www.linkedin.com/in/michelledjones1/

Instagram: https://www.instagram.com/michelle_d_jones/

Thanks for reading!